Office buildings

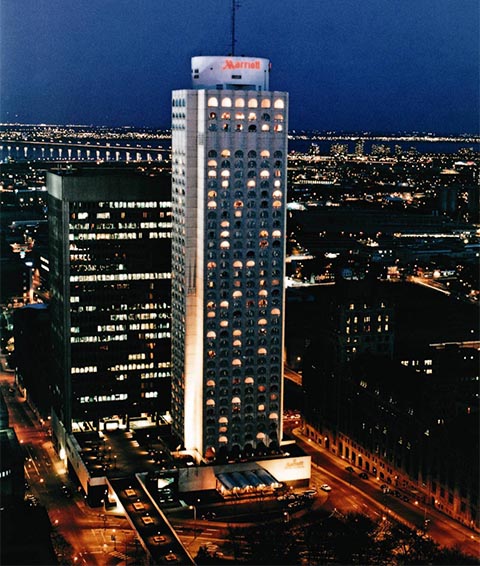

In the past, the group has been involved in the development of several major office buildings in Montreal, as well as elsewhere in Québec and in Miami, Florida. Following the acquisition or its development, as the case may be, TGTA manages the buildings to ensure the success of each of these buildings by attracting quality tenants.

With this expertise in the office building sector, TGTA began developing new office projects in and around downtown Montreal in the 2020s, particularly along major public transportation routes such as the REM. These office components are often inserted into the heart of large-scale mixed-use projects, thus contributing to the animation of the entire project by complementing other uses such as residential, commercial, institutional and community.